PayPal is a quick and efficient way to create invoices and get paid. Whether you are a freelancer, business owner, or someone who wants to learn how to create professional invoices in a few minutes, this article is for you.

In this article, you are going to understand how to create an invoice using PayPal’s invoicing tool by following 7 simple steps. You’ll learn how to make professional invoices and make it easy for your clients to pay you.

PayPal lets businesses, freelancers, and regular folks send invoices to clients and also provides a gateway to help clients make the payment in a hassle-free manner.

Now let’s discuss in detail how to create a Paypal account and send an invoice to a client.

Step 1: Visit the PayPal Website

Step 2: Click On “Sign Up“

Step 3: Decide and choose if you want an “Individual” or “Business” account.

Step 4: Once you’ve made your choice, fill in important details like your email address, mobile number, password, address, and name.

Step 5: Take a good look at the Terms and Privacy Policy and agree to them.

Step 6: Click “Create account” or “Next” to make your account. Then, PayPal will send you a code on your email and phone. Check your email and type in the code to confirm your email.

Step 7: You can connect a Credit/Debit Card or a Bank Account to your PayPal account.

Step 8: You can set Security questions.

Note: Based on your location and activity, PayPal may request additional information to confirm

But what if you have a personal account and you want to switch it to business? Here are some easy steps to switch your account from Personal to Business.

Step 1: Login to your Personal PayPal account

Step 2: Click on the setting icon (⚙️) in the upper right-hand corner of the PayPal dashboard.

Step 3: In your account settings, you should see an option labeled “Upgrade to a Business Account”. Click on it. OR Scroll down on click on “Upgrade to a Business Account”

Step 4: Provide business information such as Business Name, Business Address, Business Email Address, Legal Name, and Business Website (Optional).

Step 5: Provide additional information as per instructions provided by PayPal. PayPal may request additional details, such as your Social Security Number, Employer Identification Number (EIN), or other tax-related information.

Step 6: After providing all the necessary information, Confirm and submit.

Note: PayPal may ask you to verify your business account by confirming your email address or linking a bank account.

You can now send invoices, accept payments under your business name, and enjoy other benefits of a PayPal business account.

Now, let’s learn how to create your first invoice.

Before moving forward, you need to know what essential information we should include in our Invoice.

You can add extra information as per your requirement.

Step 1: Once you’ve created your account and linked a bank account, log in to your PayPal Business account using your email address and password.

Step 2: In your PayPal Business account dashboard, you should see an option for “Invoicing.” Click on it to Create your first Invoice.

Step 3: Click on the “Create Invoice” button to start creating a new invoice.

Step 4: Fill in all the necessary information.

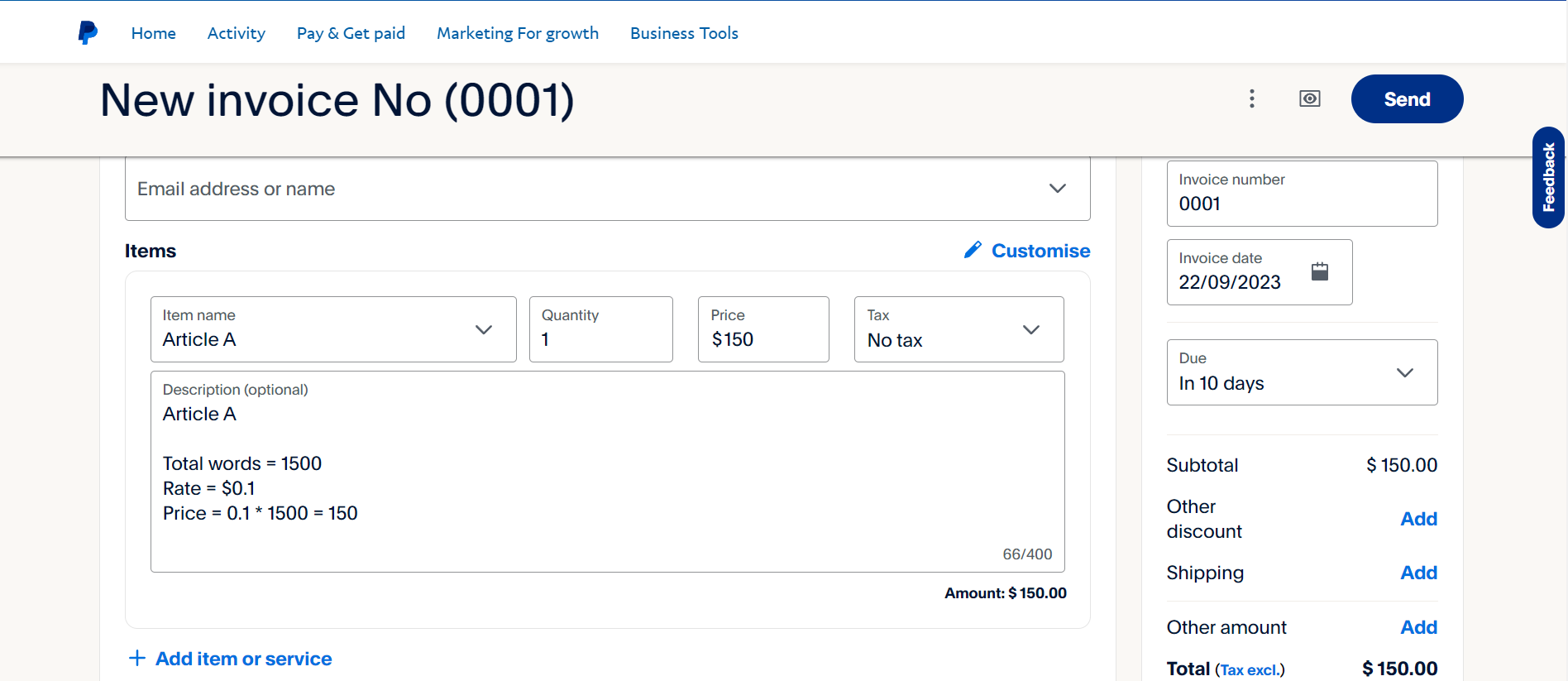

Step 5: You should add “Item” or “Service” description as follows.

Step 6: You can customize invoice settings by clicking on “More Options” at the bottom of the invoice. Here, you can choose currency (PayPal supports 25 currencies), set up tax options, and configure other invoice preferences.

After filling in all the details and ensuring everything is accurate, click the “Preview” button to review the invoice.

Carefully review the invoice for accuracy, and make any necessary adjustments.

Step 7: Once satisfied, click the “Send” button to email the invoice to your client.

There are different types of invoices you may want to send based on your work and a requirement. Let’s understand common scenarios for generating PayPal invoices.

In this billing method, the payment is tied to the completion and delivery of specific items or projects outlined in the freelance contract. The freelancer charges their clients for their services based on the specific tasks they provide.

If you are a freelancer content writer and want to get paid on a word basis. Here are some things you need to keep in your mind:

Note: You need to add the client’s email address.

Don’t forget to follow up. You can use PayPal’s automatic reminder feature to help with this.

After receiving payment, record the transaction in your accounting software or ledger. Mark the invoice as paid.

There are many platforms where freelancers charge on an hourly basis. They come up with an hourly rate for their work and multiply that by the number of hours spent doing the work.

If you are one of those freelancers and want to create invoices accordingly, this part is for you!

There are some things you need to keep in mind while creating your invoice.

By following these steps, you can effectively create and manage invoices for your freelance work on an hourly billing basis, ensuring transparency, accuracy, and timely payment for your services.

If you are a business owner or smaller seller who sells goods and wish to create an invoice for multiple customers at a time, PayPal has a solution for you as well. You can create personalized invoices for each customer. Not only that, you can calculate different sales taxes, discounts, and the remaining total due in one place.

Let’s follow these simple steps:

A well-structured invoice maintains professionalism and facilitates timely payments.

There are many more industries and fields where PayPal invoices can be sent, such as subscription-based services, consulting services, e-commerce and many more.

To ensure a smooth invoicing process and get paid promptly, consider the following best practices:

1. Accurate Contact Information: Double-check the recipient’s email address to avoid sending invoices to the wrong person.

2. Clear Invoice Details:

3. Invoice Numbering: Assign a unique invoice number for each transaction to maintain clarity and prevent confusion.

4. Payment Terms:

5. Professional Appearance:

6. Currency and Payment Methods:

7. Taxes and Fees:

8. Terms and Conditions:

9. Payment Links:

10. Sending and Follow-Up: Send the invoice promptly after delivering the products or services. Follow up with a polite reminder before or on the due date to ensure payment is not delayed.

11. Record-Keeping: Maintain a record of all sent invoices and payments received. Use an invoicing software or spreadsheet to track your financial transactions.

12. Reconcile Payments: Regularly reconcile payments received with your invoices to detect any discrepancies.

13. Secure Communication: Use secure email communication when sending invoices to protect sensitive financial information.

14. Personalized Messages: Add a brief, personalized thank-you message to show appreciation for the client’s business.

15. Backup Documentation: Attach any necessary supporting documents, such as contracts or receipts, to the invoice.

16. Accessibility and Clarity: Ensure your invoice is accessible to individuals with disabilities by following accessibility guidelines.

Yes. PayPal invoice is free. But, you have to pay fees when you get paid by your client.

Why should you use invoicing software over creating an invoice manually?It is time-saving, reduces human error, and enhances professionalism. It also offers features like automatic reminders and tracking for better payment management.

Invoices are one of the important parts of businesses and finance. Paypal is a useful platform to create invoices in detail with its invoicing feature. By following the above practices and adding the necessary information, you can create your own invoices and improve payment efficiency.

There are many other platforms that provide templates and tools to create invoices. If you want to explore them, here is an article on the Best Invoice Generators to Accept Client Payments.

ContributorSanket Sarwade is a data scientist with a specialization in machine learning, deep learning, and AI. He is interested in finance, AML and quantum computing. He has helped millions through his guide, where he tests emerging software and tools extensively and share testing results and research.

Was this helpful? Thanks for your feedback. Thanks to our partners More on Business OperationsFind and compare business software insights to increase efficiency, streamline operations, enhance collaboration, reduce costs, and grow your business.

© 2024 Geekflare LTD. All rights reserved. Geekflare® is a registered trademark.